ServiceChannel and Periscope Holdings were bought by public companies (Fortive and MDF Commerce respectively). As a result, we get a peek into the financials and valuations of two vertical B2B procurement SaaS vendors.

(Full disclosure: I worked for ServiceChannel and consulted with Periscope many years ago, but the information in this post is solely from public sources.)

Source-to-Settle Networks

At a high level, the two companies have many similarities. They both:

- offer source to settle solutions

- maintain strong positions in niche markets (ServiceChannel in facilities management, Persicope in the public sector)

- built networks of suppliers that they monetize

- forecast strong growth in 2021 and

- have limited profitability

The companies and deals diverge from there.

ServiceChannel

ServiceChannel describes itself as a “contractor/service provider network coupled with leading maintenance and repair workflow software to serve facility owners and operators across multiple end-markets.” The company describes its solution as follows:

ServiceChannel Company and Deal Metrics

Fortive provided metrics on ServiceChannel in the following diagram:

As you can see, ServiceChannel’s estimated annual revenue growth has been 30%. This means 2020 revenue was probably around $90 million, though 2020 revenue was not provided. In addition to the above metrics, Fortive’s analyst call disclosed that ServiceChannel had break-even EBITDA in 2020 and expects low single-digit “2-3%” EBITDA in 2021. Fortive believes, however, ServiceChannel can be a “Rule of 40” company in the second half of 2022.

Three other interesting notes:

- 95% of ServiceChannel revenue is from North America.

- While the company disclosed it has software fees for buyers and transactional fees (based on spend) for suppliers, ServiceChannel did not disclose how much each contributes to revenue. Fortive management did say it thought the mix might be 50:50 in five years, implying that software fees are much larger now, but transactional fees are growing faster.)

- With revenue of $125 million on $7 billion in annual spend, think of ServiceChannel’s total “take rate” as 179 bps.

Fortive paid $1.2 billion for ServiceChannel. As a result, the company paid about 13x 2020 revenues and 10x expected 2021 revenues. That’s a “Rule of 40” type price for a slightly less than Rule of 40 company. It’s likely justifiable given the other assets Fortive brings to bear in the facilities space (e.g., Accruent and Gordian). It may be one of those cases where everyone got a good deal. Congrats to the Bayard Capital and Accel teams.

Periscope

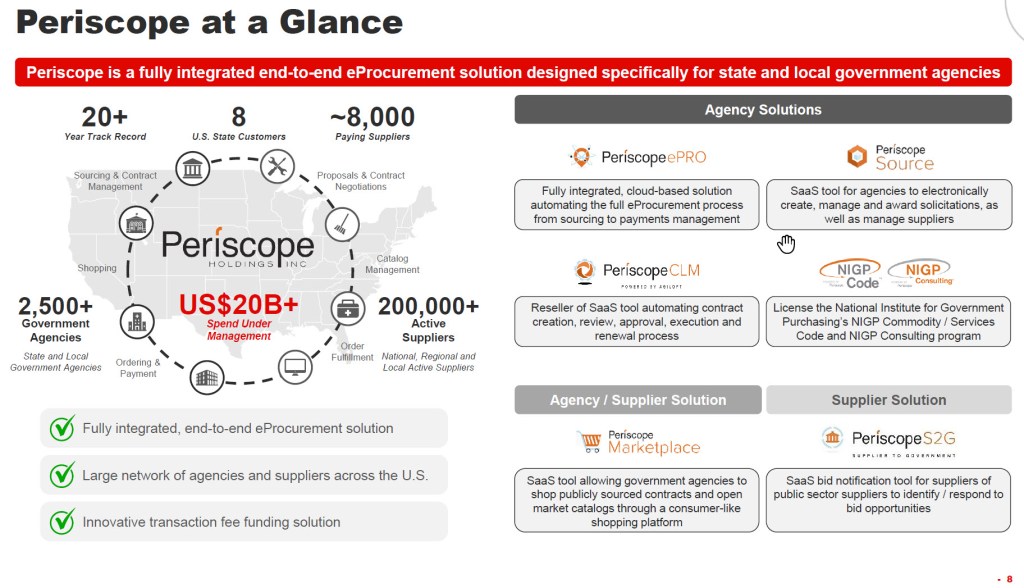

Periscope describes itself as a “fully integrated end-to-end procurement solution designed for state and local government agencies.” I’d add that it is a solution for agencies and their suppliers. As ServiceChannel does, Periscope monetizes both buyers and suppliers. State agencies (buyers) can either license the e-procurement software directly or elect to have suppliers pay a fee Periscope shares with the agencies. The company also offers a bid notification product for suppliers.

Here’s a picture of Periscope’s offering:

Periscope Company and Deal Metrics

We have a much fuller picture of Persicope’s financials than ServiceChannel’s. See the portion highlighted in yellow below:

MDF Commerce paid 8.4x Periscope’s 2020 revenues. The company expects Periscope to grow from $23.1 million in 2020 to $33 million (43%) in 2021. This makes the purchase price about 6.3x 2021 revenues. As you can see, Periscope had EBITDA of about 8% in 2020. (Its net income was slightly negative.)

MDF Commerce paid 8.4x Periscope’s 2020 revenues. The company expects Periscope to grow from $23.1 million in 2020 to $33 million (43%) in 2021. This makes the purchase price about 6.3x 2021 revenues. As you can see, Periscope had EBITDA of about 8% in 2020. (Its net income was slightly negative.)

MDF Commerce expects to see both revenue synergies from cross-selling and cost synergies in a variety of areas. (Persicope’s acquirer, is a major player in the bid notification business. I have previously written about MDF Commerce when it was called Mediagrif.) Both synergies seem logical, but logic is not execution, just as hope is not a strategy! Congrats to Brian Utley and the team at Periscope Holdings.

Strategic acquirers are very active in facilities management and public sector SaaS companies, as well as among procure-to-pay vendors. It’s no surprise to see two companies at the confluence of these areas get gobbled up.

Recent Comments